Introduction

CM Asaan Karobaar Card: Starting and running a business often requires financial support, and securing a loan with no interest is a golden opportunity. The Punjab government has launched the Asaan Karobaar initiative to provide interest-free loans to residents of Punjab, helping them grow or establish their businesses. This initiative consists of two schemes:

- Asaan Karobaar Finance (For established businesses)

- Asaan Karobaar Card (For new and small businesses)

Let’s dive deep into the details of this game-changing scheme and understand how you can apply for it.

What is Asaan Karobaar?

The Asaan Karobaar initiative is a government-funded program offering zero-interest loans to individuals in Punjab to support their entrepreneurial journey. The loans are available under two schemes:

1. Asaan Karobaar Finance

- Loan amount: PKR 1 million to PKR 30 million

- Repayment period: Up to 5 years (installments)

- Eligibility:

- Must be a resident of Punjab

- Age: 25 to 55 years

- Valid CNIC

- No history of loan default with financial institutions

- Active tax filer

- Must own or rent a business location

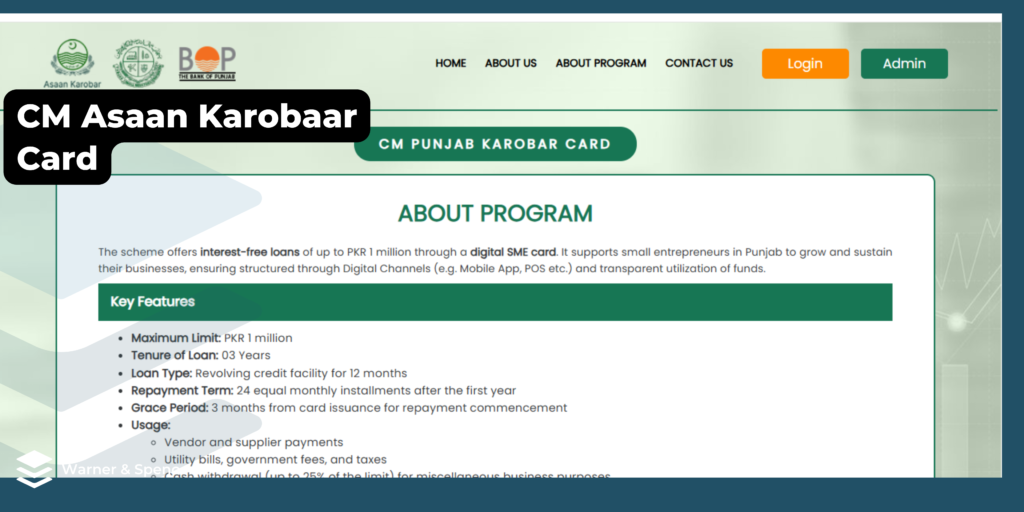

2. Asaan Karobaar Card

- Loan amount: PKR 100,000 to PKR 1 million (interest-free)

- Repayment period: Up to 3 years (installments)

- Eligibility:

- Must be a resident of Punjab

- Age: 21 to 57 years

- Valid CNIC

- Business or potential business must be in Punjab

- Must be an active tax filer

- No prior business experience required (great for new entrepreneurs)

How to Apply for Asaan Karobaar Loans?

Applying for the Asaan Karobaar initiative is simple and can be done online.

1. Applying for Asaan Karobaar Finance

Visit akf.punjab.gov.pk and fill out the application form.

2. Applying for Asaan Karobaar Card

Visit akc.punjab.gov.pk and apply online.

Step-by-Step Guide to Apply for Asaan Karobaar Card

If you are applying for the Asaan Karobaar Card, follow these simple steps:

1. Visit the Official Website

- Open akc.punjab.gov.pk

- Click on “Apply for Asaan Karobaar Card”

2. Confirm Eligibility

- Must have a CNIC-linked mobile number

- Details should match NADRA records

- Must be a resident of Punjab

- Agree to terms and conditions

3. Create an Account

- Enter Full Name (as per CNIC)

- Provide Father’s/Husband’s Name

- Enter CNIC Number

- Provide Date of Birth

- Enter CNIC Issuance & Expiry Date

- Provide Mobile Number & Network

- Set a Password and confirm it

- Click Register

4. Login & Complete Application

- Enter CNIC Number & Password

- Click Login

- Fill in Personal Information:

- Gender

- Current Address

- City & Residential Status (Owned/Rented)

- Number of Dependents

- Education Level

- Employment Status (Job/Business/Unemployed)

- Work Experience (if any)

5. Provide Business Details

- Select Business Type (Manufacturing, Trading, Services)

- Provide Business Start Date

- Enter Business Name & Contact Info

- Provide Business Address

- Select Region, District, Tehsil

- Mention Business Registration (Yes/No)

- Give a brief description of the business

6. Select Loan Amount

- Choose the loan amount (PKR 100,000 – PKR 1 million)

- Confirm business purpose for the loan

7. Upload Required Documents

- Front & Back of CNIC

- Bank Statement (if available)

8. Submit Application & Pay Processing Fee

- After submission, pay the processing fee through Easypaisa, Bank Transfer, or ATM.

- Once payment is confirmed, your application will be processed.

Why Apply for Asaan Karobaar Loans?

- Zero Interest: No markup or hidden charges

- Government-Backed: Safe and secure funding

- Simple Process: Easy online application

- Supports Startups: Even new entrepreneurs can apply

- Flexible Repayment: Installments up to 3-5 years

Conclusion

The Asaan Karobaar initiative is a game-changer for entrepreneurs in Punjab. Whether you want to expand an existing business or start a new venture, this interest-free loan is the perfect solution. With easy eligibility criteria and a seamless online application process, there’s no reason to miss out on this incredible opportunity. Apply today and take the first step toward your business success! 🚀

FAQs

1. Is the Asaan Karobaar loan completely interest-free?

Yes, both the Asaan Karobaar Finance and Asaan Karobaar Card are 100% interest-free with no hidden charges.

2. Can I apply if I don’t have an existing business?

Yes! The Asaan Karobaar Card is designed for new entrepreneurs, so you don’t need an existing business to apply.

3. What happens if I miss an installment?

Missing an installment may affect your credit history and future eligibility for government schemes. It’s best to ensure timely payments.

4. How long does it take to get the loan approved?

The approval process depends on document verification, but typically takes a few weeks.

5. Can I apply if I’m not a resident of Punjab?

No, this scheme is only available for residents of Punjab.